Podcast: Play in new window | Download

Guest

Today we interview Dr. David Tubens. He’s a metaphysical practitioner and ordained minister. We discuss a bit of his life story. He reminds us that psychology can only take us so far. The spiritual aspect of life needs attention too.

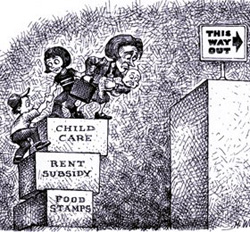

David comes from humble beginnings and shares some of his story of growing up on the streets of NY and being homeless at one point. He was a 7th grade drop out who earned a GED and later became a police officer.

Wanting to study psychology and work for the FBI, he eventually realized helping people with the spiritual aspect of their lives was more fulfilling.

We discuss his counseling practice, the difference between new thought and new age, and are reminded that if you want to change it’s gonna take effort on your part! No hand holding here. Of course, true to Debt Shepherd form, we tie it all in and explain how you can apply your spiritual practice to your financial freedom endeavors as well.

Resource:

David can be found at YourLifeRenewed.org link

Or you can email him: Dr Tubens

Action:

Be aware of the words you use. They are creating your world.

Take 100% responsibility for your life. You have the power to change it.

Give us a call on our voicemail feedback hotline at 615-200-7189 or drop Greg an email.