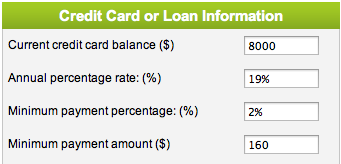

This loan will take 8.3 years to pay the balance. Total interest paid is $7,977.

How does the bank do this? You deposit $8,000 into your CD, checking, or savings account. Your bank pays you a whopping 1 to 2% interest for the use of your money. They turn around and lend it out and charge 19% to their customers.

Those same customers might or might not have $8,000 on deposit with the bank. Your bank is making $8,000 in interest for the use of your money. That’s a 100% return on investment for the bank. And they have the nerve to charge you an overdraft fee of $30.00 if you make a mistake in your checkbook ledger and get overdrawn once in a blue moon.

We are NOT winning this game. It was built so we would lose. Ever wonder why you can never seem to get ahead even if you’re not a spender and are a saver? Inflation is eroding your purchasing power. Inflation is an intentional tax. It’s caused when The Federal Reserve prints more money. And they call is “easing.” Easing what? Easing the pain their profit margin might feel.

The banking system known as The Federal Reserve is the most insidious system of economic slavery the world has ever known. And it’ll be 100 years old on 12/23/2013. I don’t know about you, but I won’t be sending a card or buying a birthday cake.

What to do? Get out of debt as quickly as possible. Learn to barter. Pay cash. That’s a start.

Give us a call on our voicemail feedback hotline at 615-200-7189 or drop Greg an email.