Podcast: Play in new window | Download

A wise man once said if we spent as much time working on our inner standing (enlightenment) as we do on the pursuit of paper (money), we’d already be adepts. Agreed. How long have you been chasing money? Why do you? Who told you that’s what you’re supposed to do?

I’m 43 and just learning to slow down my chase of money. Still doing it, yes. More aware I want to slow down and eventually stop? Yep. I still build the vision of a day without having to use it in this thing called the 3D world.

Definition:

A meme [1] is “an idea, behavior or style that spreads from person to person within a culture.”[2] A meme acts as a unit for carrying cultural ideas, symbols or practices, which can be transmitted from one mind to another through writing, speech, gestures, rituals or other imitable phenomena. Supporters of the concept regard memes as cultural analogues to genes in that they self-replicate, mutate and respond to selective pressures.[3]

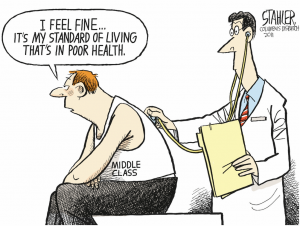

I’m seeing money as a massive meme. The idea of earning, spending, saving, and storing it is a learned behavior. We chase paper that holds only perceived worth because the collective says it has worth. We’re taught from cradle to grave this is life. We fear not having enough of this paper. We fear the punishment of not giving enough of this paper to government (taxes).

What is a contract? A piece of paper. Think of contract as a verb, not a noun. When something contracts, it tightens, squeezes shut, becomes smaller. Hmmmm….

We even buy into allowing someone else to define our very freedom by what they write on a piece of paper. They call it a law but it starts out first as a bill. Sound like money? The power of paper. The power of our acceptance of the idea the paper has power.

I’m seeing a life with less money, less need for it, less chasing of this paper. I encourage you to join me in this thought exercise. It starts with gaining knowledge.

Resource:

Virus of the Mind: The New Science of the Meme

Give us a call on our voicemail feedback hotline at 615-200-7189 or drop Greg an email at:

greg [at] debtshepherd [dot] com

2012 Copyright – Greg A. Whitaker – All Rights Reserved